What is Gift Aid?

Gift Aid is a simple way for our Scout Group to increase the value of your donations and subscriptions to the Group if you are a UK taxpayer.

How does Gift Aid work?

When a UK taxpayer gives a gift of money to a charity they have already paid tax on that money. Because charities are generally exempt from tax, they can claim an amount from HM Revenue and Customs (HMRC) equal to the tax paid on that money by the donor. This repayment is known as Gift Aid.

How much is Gift Aid worth to our Scout Group?

By asking donors permission to reclaim the tax they have paid on their donation, we can increase the value of that donation by one quarter, i.e. for every £1.00 paid as a subscription we can claim back 25p making it worth £1.25 to the Group.

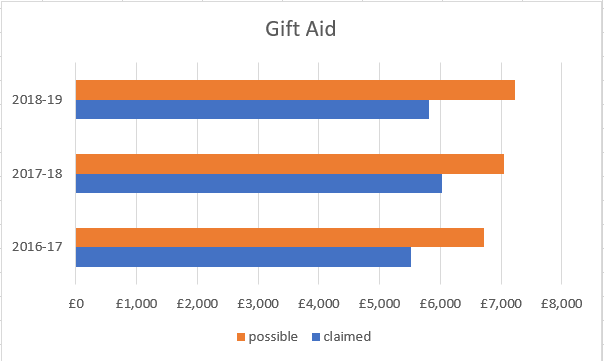

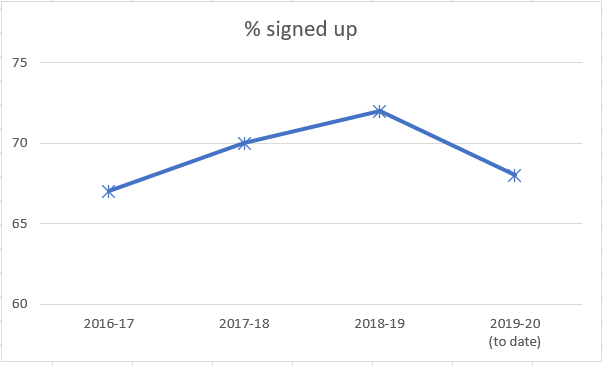

In the 2016-17 tax year we reclaimed £5,523 of a possible £6,721, but only had 67% of those paying subscriptions signed up to the scheme.

In the 2017-18 tax year, we reclaimed £6,024 of a possible £7,051, with an increase to 70% signed up. An improvement - but we still missed out on over £ 1,000 !

Whilst in the 2018-19 tax year, we reclaimed £5,808 of a possible £7,224, with an increase to 72% signed up. The amount claimed fell back again.

We really want to be able to do even better, as it is through reclaiming this money we manage to avoid raising subs! If there is any chance your details may have changed or you have not completed a form, please download and return to one of your child's section leaders as soon as possible.

Why are Gift Aid Declarations important?

A donor must have paid enough tax on their income before a charity can claim it. It is important that HMRC can verify the connection between our tax repayment claim and the tax paid by the donor. In other words, every claim must be supported by a Gift Aid Declaration that shows who paid the tax in the first place.

Frequently Asked Questions

No, it is very simple and only requires that you declare that you want your subscriptions to be treated as Gift Aid payments.

No. One declaration covers all payments you make in respect of their subscriptions.

No, the Group will simply claim back tax that wold otherwise have gone to the Inland Revenue. We can then use this tax to reduce the impact of subscription increases.

No. All that is needed is very basic information including your name, address and confirmation that you want your Subscriptions to be treated as Gift Aid.

Nothing, once you have completed the declaration this covers your child(ren) until they leave the Group. You need only notify the Group if you change name, address or are no longer able to confirm the details on the declaration.

Nothing, as the Gift Aid declaration is not in respect to a specific sum but merely the subscription, however much that will be.

If you stop paying tax or have paid insufficient tax to cover the amount the Group will be claiming back, you should inform the Scout Group and they will not make a claim for your payments.

As there is no legal commitment in a Gift Aid declaration the Group will only claim back the tax on the payments you made before the child left the Group.

Although the Group can only claim back tax at the standard tax rate, higher rate taxpayers can claim the difference back as tax relief on their self-assessment forms.